Now here is a story for you.

Just imagine that you buy something over the Internet and it never arrives. It happened to me once with a folding bike, and I lost my money. But at least if you use PayPal you have some chance to get your money back. Oh the benefits of hindsight!

So you buy something from a company over the Internet. The object does not turn up. You call the company, no answer, you write to them repeatedly, send them emails, try all the numbers you can find but nobody responds.

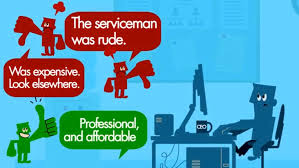

What do you do? You go on a review site and you tell the story. Well that is a dangerous game!

As this article on CNN explains, in 2008 John Palmer bought his wife Christmas gifts off KlearGear.com. The gifts didn’t arrive and he followed the path described above as many of us would.

More than three years later, Mr Palmer received an e-mail appearing to be from KlearGear.com stating that they would be fined $3,500 if the negative review wasn’t taken down within 72 hours.

So as any threatened person would he tried to have it removed. But the review company couldn’t remove it without entering into arbitration, costing money, so the review remained.

What about freedom of speech? Well you might well ask. When you buy something or have any contracted action with a company you might be signing away your freedom of speech. Yes, fine print.

If you look in the terms of sale and you find something like the following “Your acceptance of this sales contract prohibits you from taking any action that negatively impacts KlearGear.com” as in the sale mentioned above, you waive your rights goodbye.

The company can stipulate how much you are liable for as well. Then you have to pay up or go to court, run up huge legal bills and argue that the clause is not legal.

With Christmas just round the corner, Kwanzaa and birthday presents to shop for, holidays and flights to book and many others, what are we going to do? Do we have time to read 10 pages of contractual terms each time we buy something? Would we understand it anyway?

It looks like another form of cyber-bullying to me.